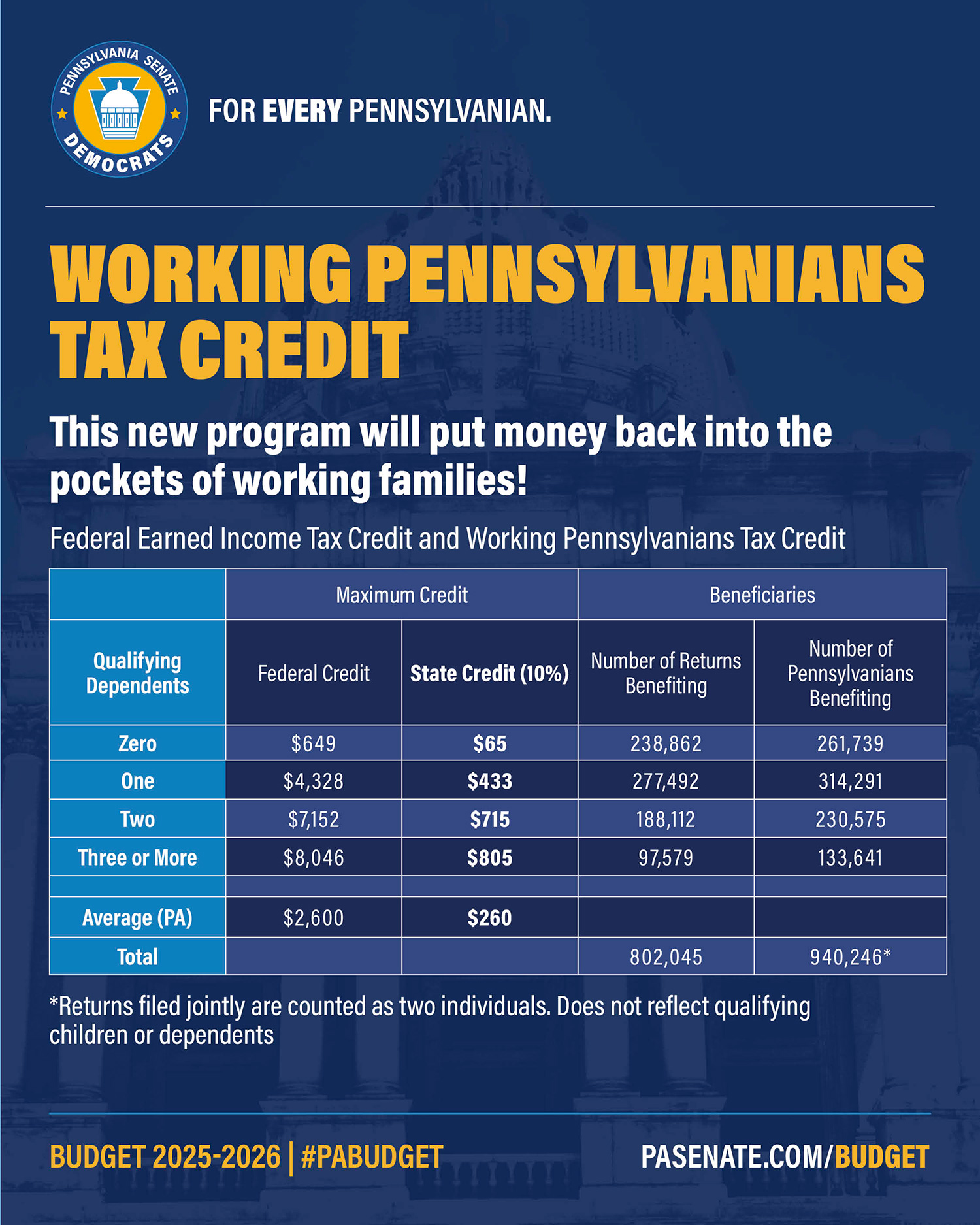

On November 12, Governor Shapiro signed into law the 2025-26 Pennsylvania Budget, which included the creation of the Working Pennsylvanians Tax Credit. This $193 million program offers a state tax credit worth 10% of the Federal Earned Income Tax Credit, and will benefit nearly one million Pennsylvanians this coming tax season.

If you qualify for the federal Earned Income Tax Credit, you automatically qualify for the Working Pennsylvanian Tax Credit. The easiest way to claim the credit is to file your federal and state tax returns online at the same time.

The Shapiro Administration has made it easy to determine whether you qualify and how much money is going back into your pocket with a NEW online working Pennsylvanian tax credit calculator, developed in partnership with CODE PA and the Pennsylvania Department of Revenue. Simply input your filing status, number of dependents, and annual income, and the calculator will tell you how much money you can expect in tax credits from this year.